- Carbon Credits: Carbon credits play a crucial role in financing by providing a mechanism for funding environmentally sustainable projects and facilitating investments in green technologies.

- Tax Deductions: This type of incentive allows entities to deduct the cost of the renewable energy investment from their income, reducing the total taxable income. For example, the cost of purchasing and installing solar PV can be deducted, lowering the overall income tax liability.

- Accelerated Depreciation: This allows businesses to depreciate the value of the renewable energy asset more quickly, reducing taxable income at a faster rate than normal. In many jurisdictions, this can include methods like Modified Accelerated Cost Recovery System (MACRS) which significantly shortens the depreciation time for energy equipment.

- Rebates: These are direct reimbursements for part of the purchase price of renewable energy technologies. While not a direct tax incentive, they reduce the overall cost, making the investment more attractive and feasible.

- Exemptions: These can include exemptions from sales tax, property tax, or other local taxes for the installation and operation of renewable energy equipment, further lowering the cost of investing in such technologies.

Harnessing Benefits

Tax Incentives and Benefits of Renewable Energy in South Africa

Importance of tax incentives

Tax incentives play a crucial role in promoting renewable energy investments in South Africa, primarily by making these investments financially more attractive and feasible for businesses and individuals.

- Lowering Capital Costs

- Encouraging Innovation and Development

- Attracting Foreign and Local Investment

- Meeting Environmental Targets

- Improving Energy Security

Section 1: Understanding Tax Incentives for Renewable Energy

Examples of Tax Benefits in South Africa

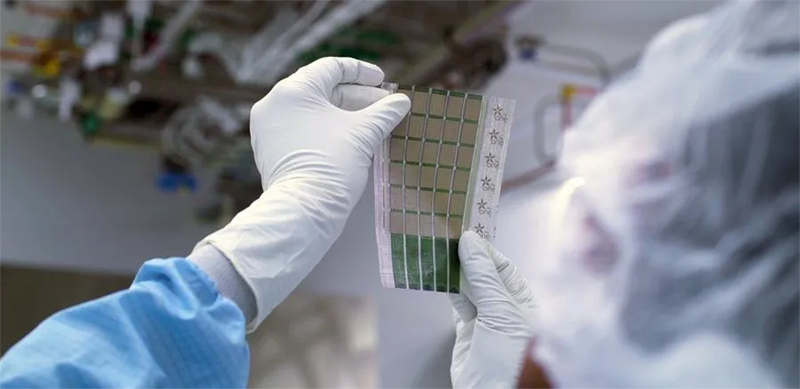

Accelerated Depreciation (Section 12B of the Income Tax Act):

Businesses investing in renewable energy assets can benefit from an accelerated capital depreciation allowance. This includes a 100% deduction in the first year for solar photovoltaic (PV) projects below 1 MW, and a structured deduction over three years (50% in the first year, 30% in the second year, and 20% in the third year) for projects above 1 MW. Recent updates have also introduced a 125% deduction in the first year for all renewable energy projects, regardless of their generation capacity, which is applicable for assets brought into use for the first time between March 2023 and February 2025 (SA News) (Cliffe Dekker Hofmeyr) (UNCTAD Investment Policy Hub) (RSM Global).

Section 12L: Energy Efficiency Savings Tax Incentive:

This incentive provides a tax deduction for businesses that implement energy efficiency measures. Companies can claim a deduction of 95 cents per kilowatt-hour (or equivalent) of energy saved as certified by the South African National Energy Development Institute (SANEDI). This encourages businesses to invest in energy-efficient technologies and practices, leading to reduced energy consumption and costs.

Research and Development (R&D) Tax Incentive:

Under Section 11D, companies engaged in scientific or technological R&D can claim a 150% deduction on qualifying R&D expenditure. This incentive aims to boost innovation and development in various sectors, including technology, manufacturing, and renewable energy. By reducing the effective cost of R&D activities, this benefit encourages companies to invest more in developing new products and processes.

Section 2: Current Tax Benefits for Renewable Energy Projects

Accelerated Depreciation (Section 12B of the Income Tax Act)

Overview: Section 12B of South Africa’s Income Tax Act provides an accelerated depreciation allowance for investments in specific renewable energy assets. This tax incentive is designed to encourage businesses to invest in renewable energy by allowing them to recover the costs of their investments more quickly through tax deductions.

Details of the Incentive:

- Eligible Assets: The allowance applies to machinery, plant, implement, utensil, or article used in the production of renewable energy. Eligible sources include wind power, solar energy, hydropower (below 30 megawatts), biomass, and photovoltaic projects (above 1 megawatt).

- Deduction Rates: Typically, businesses can deduct the cost of these assets at an accelerated rate:

- 100% in the first year for small-scale projects, specifically solar PV projects below 1 megawatt.

- 50% in the first year, 30% in the second year, and 20% in the third year for larger projects above 1 megawatt.

- Recent Changes: A recent update to the policy allows for a 125% deduction in the first year for all renewable energy projects, irrespective of their generation capacity, for assets brought into use between March 2023 and February 2025. This is an enhancement aimed at further stimulating investment in renewable energy amid the ongoing energy crisis.

Deductions for Renewable Energy Production

Overview: Beyond the accelerated depreciation, South Africa’s tax regime includes provisions for deductions related to the broader production of renewable energy. These deductions are part of the government’s efforts to promote the generation of clean energy and reduce national dependency on fossil fuels.

Specific Deductions:

- Production Incentives: Businesses involved in the production of renewable energy may qualify for additional tax deductions related to the costs of production. This can include costs related to the construction and operation of renewable energy facilities.

- Investment Deductions: Investments in renewable energy infrastructure, beyond the assets covered under Section 12B, might also qualify for deductions. This could include costs associated with upgrading existing facilities to be more energy-efficient or environmentally friendly.

- Feed-in Tariffs: While not a direct tax deduction, businesses generating renewable energy may benefit financially from feed-in tariffs, where excess energy produced and fed back into the grid can result in monetary credits or deductions against energy costs.

Impact and Importance: These tax incentives significantly reduce the financial burden on businesses transitioning to renewable energy sources. By accelerating the rate at which investments can be recouped through tax relief, the government not only makes renewable energy projects more economically viable but also aligns with global and national sustainability targets.

The combination of Section 12B benefits and additional deductions for renewable energy production underlines South Africa’s commitment to fostering a sustainable and independent energy sector. This approach not only helps mitigate the ongoing energy challenges but also positions the country as a leader in the adoption of renewable technologies in the region.

How these incentives reduce the overall project cost and encourage investment

Section 3: Navigating the Tax Incentive Landscape

- Understand Eligibility and Requirements: Before planning your investment, ensure that you fully understand which types of renewable energy projects are eligible for tax incentives, including specifics such as asset types and project scales. Knowing the details of Section 12B of the Income Tax Act and other relevant provisions is crucial.

- Early Planning and Consultation: Engage with tax professionals or consultants who specialize in renewable energy financing early in the project planning phase. They can provide valuable insights into how to structure the project to maximize tax benefits.

- Documentation and Compliance: Keep detailed records of all expenditures and ensure that all renewable energy assets are documented correctly. Compliance with all regulatory requirements is essential to qualify for tax incentives.

- Stay Informed on Policy Changes: Tax incentives can evolve, with new benefits being introduced and existing ones being updated. Regularly check for updates from relevant government departments or through professional advisories.

Resources and Government Entities

- South African Revenue Service (SARS): SARS is the primary entity handling tax issues in South Africa. Their website provides guidelines and updates on tax incentives related to renewable energy.

Website: SARS - Department of Mineral Resources and Energy (DMRE): DMRE oversees the energy sector, including renewable energy policies and incentives.

Website: DMRE - South African National Energy Development Institute (SANEDI): SANEDI supports the development of renewable energy and energy-efficiency sectors through research, development, and demonstration projects.

Website: SANEDI - Council for Scientific and Industrial Research (CSIR): CSIR conducts research in various technological and energy areas, providing insights and developments in renewable energy.

Website: CSIR - Renewable Energy Hub: This platform offers resources, tools, and the latest news regarding renewable energy projects in South Africa, including insights into financial incentives.

Link: Renewable Energy Hub

Section 4: Case Studies of Tax Incentive Impact

Conclusion

Tax incentives in South Africa have greatly helped the growth of renewable energy projects, pushing the country towards more sustainable energy solutions.

Programs like the REIPPPP and large allocations for wind and solar power show how well public-private partnerships and supportive tax policies can work together to boost renewable energy development. These incentives have made it easier and cheaper to invest in renewable energy, making it more economically viable and environmentally friendly. Continuing to improve and expand these policies will be important for ongoing growth in this sector.

This highlights the need for new ideas and simpler rules to fully tap into the potential of renewable energy across South Africa.